|

.

|

|

|

Text-to-911

Frequently Asked Questions (FAQ)

This FAQ provides valuable information about how to text 911. To help residents understand more about the services, for both emergency responders and area residents the Regional 911 Board has produced this document.

What is Text-to-911?

Text-to-911 is the ability to send text messages from a cell phone to local 911 centers. Examples of when Text-to-911 is beneficial:

- The caller cannot speak due to a threat, illness, medical condition, or other physical limitation.

- The caller has poor reception and can only send out a text message.

- When cell phone towers are overwhelmed and only texts can get through.

Is Text-to-911 available to me?

Text-to-911 is available for the cities of Broken Arrow, Bixby, Collinsville, Glenpool, Jenks, Owasso, Sand Springs, Sapulpa, Skiatook, Tulsa and the counties of Tulsa, Rogers, and Osage.

What are Text-to-911 limits?

Text messages also can take longer to receive and are not prioritized.

- Text messages may be delivered out of order or may not be received by the 911 center.

- Text-to-911 does not work if the sender texts using a group message, emojis, or sends pictures or videos.

- Mobile applications that text other application users, such as WhatsApp and Facebook Messenger do not support Text-to-911.

What languages can be used?

Text-to-911 is only available in English.

How do I know a 911 center received my text?

The only way to know a text has reached a 911 center is when the center texts back. If you believe a text has not been received by a 911 center, call 9-1-1. If you are outside the text to 911 service area your cell phone service provider shall send an immediate bounce-back message stating “Text to 911 is not available in this area”.

Why is it better to make a voice call to 9-1-1?

Voice calls to 9-1-1 are the most efficient way to reach emergency help. The disadvantages of texting to 911 include:

- Texting takes more time and is limited to text messages.

- Cell phone providers may not relay the message from the sender to the 911 center.

- A person cannot text 911 without a service contract that includes texting.

- Texting to 911 may not automatically provide the location of the phone texting.

How to text 911 when you’re having an emergency:

- To text 911, create a new text message.

- Enter “911” into the “To” field. No dashes are necessary.

- In this text message, include the following in the very first text:

- Location or address of the emergency including the business name, park name, etc.

- Include the type of help needed: Medical, Fire, and/or Law Enforcement.

- Nature of the emergency

- Your name

- Keep text messages short, simple, and do not use abbreviations or acronyms.

- Remain in close contact with your phone and be prepared to answer questions and follow instructions from the 911 Telecommunicator.

- If safe to do so, remain on scene until help arrives.

Questions? Or for additional information contact your local 911 center.

For an educational video on Text-to-911 for the hearing or speech-impaired follow this link: https://www.youtube.com/watch?v=j509tezozmY

9-1-1 Services

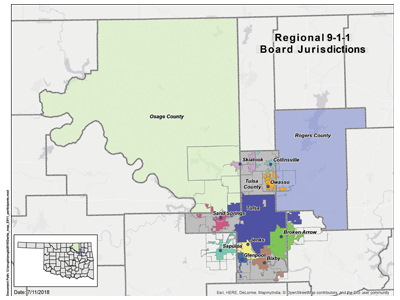

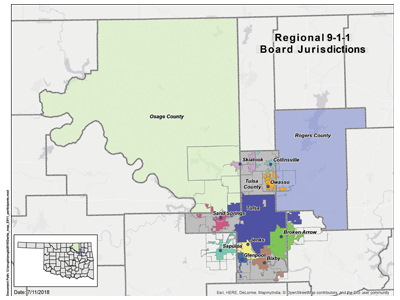

The Regional 9-1-1 Board is a voluntary association of 13 individual Public Safety Answering Points (PSAPs), more commonly known as 9-1-1 Public Safety Communications Centers, independently operated, most typically within the Police or Sheriff's Department.

Member jurisdictions have appointed a board member as one of the managing members to the Regional 9-1-1 Boards of Directors. Those jurisdictions are: Tulsa County/ Tulsa County Sheriff'’s Department, Osage County/ Osage County Sheriff'’s Department, Rogers County/ Northeast Oklahoma 911 Trust Authority, City of Bixby, City of Broken Arrow, City of Collinsville, City of Glenpool, City of Jenks, City of Owasso, City of Stand Springs, City of Sapulpa, City of Skiatook, and City of Tulsa.

Verifying 9-1-1 Fees

Landline 9-1-1 Fees are paid by the telecommunication company directly to the city or county assessing the fee.

Click here for a list showing the rates and the remission address.

Wireless, VoIP and prepaid fees are paid directly to the Oklahoma Tax Commission. The Taxpayer Assistance line at 800 522 8165 can assist telecommunication companies in complying with the current law. https://www.ok.gov/tax/.

Which Jurisdiction Answers My Calls?

Call taking boundaries may not follow jurisdictional boundaries because of interlocal agreements, telephone exchanges, or emergency responder territories.

If you have a question which jurisdiction answers your 9-1-1 call, contact 918-579-9428 or bgibson@incog.org.

Click here for the complete map.

|

.JPG)

|

|

Need a 9-1-1 Address?

All new addresses have to comply with 9-1-1 formatting and must be pre-entered into a database in order to get the emergency responder to the right place when you dial 9-1-1. If you need a 9-1-1 address assigned, contact your local jurisdiction.

If you need to verify an address for 9-1-1 or need to establish a new address in the Unincorporated areas of Tulsa County, City of Collinsville or the Town of Sperry; please click on the link below to fill out the attached address application and submit it to INCOG. We will respond to your requests as soon as possible.

Address Request Form

|

For more information, contact:

Jared Hurst

Regional 9-1-1 Coordinator

918-579-9487

jhurst@incog.org

|

|

![]()